Cash and Non-Cash Gifts

When most people think of gifts, they think of cash gifts. But when it comes to charitable gifts, there may be a better way. Scouting, of course, always appreciates cash gifts – but cash gifts often affect your cash flow and usually represent after-tax dollars. You may not realize that non-cash gifts may have the same impact as cash gifts on your tax liability – and, in some instances, may offer an even better tax outcome.

As a general rule, for property you have owned for more than 12 months, you receive a charitable tax deduction that equals the current, fair market value of the property. could be a significant benefit for some taxpayers. You may, of course, still contribute property that you have owned for less than 12 months, but your tax benefits may be more limited.

Of course, with any gifts, please pay attention to the need to substantiate your gifts. For gifts of more than $250, this typically requires at least a dated letter or receipt, describing the gift, and identifying you as the donor. For larger, non-cash gifts, more substantiation may be needed. But please visit with your own advisor about the substantiation rules for gifts.

Giving Questions? Scouting Answers…

The booklets below show examples and answer questions regarding income producing gifts and outright gifts. Great to help you plan your planned giving.

Click on the following to learn more about some of the most popular ways to make a gift.

Publicly Traded Securities

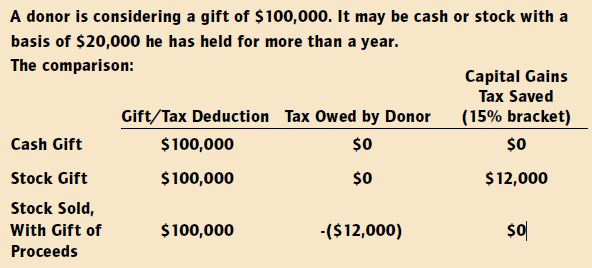

For many donors, gifts of stocks or bonds can provide tax benefits that are even greater than for cash gifts—especially if those securities have appreciated in value. Securities you have owned for more than a year are deductible up to 30 percent of your adjusted gross income (AGI) every year. Those held for less than a year are deductible up to 50 percent of your AGI every year. Excess deductions for both may be carried over for five years after the year of gift.

If your securities are worth less than you paid for them, you may receive greater tax benefits if you sell them and donate the cash proceeds. You can also donate securities you’ve owned for less than one year, but your deduction is usually limited to cost basis. As with all gifts, discuss these with your advisers; there may be other tax advantages to you for gifts of short-term property with little or no appreciation.

ESTATE PLANNING TIP

If you have appreciated securities, contribute them to Scouting.| Uncle Sam likes it when you sell appreciated securities as you pay capital gains on the appreciated value. Donate appreciated securities and take a charitable deduction for the full market value, if you have owned the securities more than one year.

Example of a Stock Gift

Closely Held Stock

Often very highly appreciated in value (and expensive to sell), gifts of closely held stock offer the same tax advantages as a gift of common stock. In fact, some donors use these gifts as a way to indirectly transfer ownership to others such as family members, or regain control of the shares and establish a new cost basis for them. The advantages of closely held stock are similar to those of publicly traded stock gifts, but an appraisal may be required to establish market value of shares.

Stock Options

Stock options can be a valuable and often “painless” gifts to a local council, as you are giving away something you don’t actually own yet. But gifts of stock options can pose certain challenges. For example, gifts of stock options will not produce an immediate tax deduction. The value of the gift won’t be known until after the option is exercised: when it is, your deduction equals the difference between the option price and the stock value. In fact, some stock options may not be contributed, under the terms of the option. If considering such a gift, consult your governing option agreement and advisers.

Gifts of cash are the most basic and important source of support for Scouting. They are easy and popular, and you are entitled to a charitable income tax deduction equal to the full value of the gift. Also, the higher your tax bracket, the more your charitable tax deductions are worth to you. As a general rule, a cash gift is:

- Deductible up to 50 percent of your adjusted gross income each year. Unused deductions may be carried over and used for five years after the gift is made.

- Complete on the date it is hand delivered or mailed. For example, a year-end gift mailed in December is deductible that year, even if not received by the council until January.

If you would like to give online, please visit the Scouting Gives page by clicking HERE. You can give to a local council or National BSA. Many prefer online giving as there is a double benefit of using your credit card to earn points on your donations or set up recurring donations.

Gifts of Land, Homes, and Farms

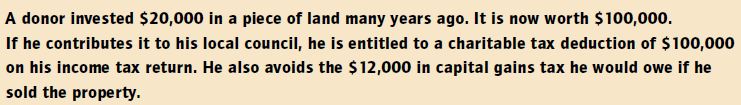

As with many people, your real estate holdings may be your most valuable assets. These assets can also carry a high price: property tax and maintenance costs, if held; capital gains tax, if sold. A gift to the BSA of real property—residential, rental, vacation homes, farms, commercial, or undeveloped—may offer significant benefits.

- Land held for more than one year is deductible at fair market value up to 30 percent of a donor’s AGI for the year. If held for less than a year, it is deductible up to 50 percent of AGI for the year, and the deduction is limited to the property’s cost basis. The five-year carryover rule applies here as well.

- Property with a mortgage or lien usually does not make a good gift. The tax deduction is reduced by the debt amount, and the donor is treated as receiving a similar amount in income, regardless of who is responsible for the debt.

Before deciding how to give real property, know (1) the appraised value of the property and (2) your basis and any debts or liens on the property. Also, please discuss your gift with the BSA so there is a mutual understanding about whether the property will be used, sold, or if there are any environmental concerns.

ESTATE PLANNING TIP

An outright gift of real property can save you time and money. | Avoid continued maintenance costs and capital gains tax on any appreciation in the value of the property. You can also take a charitable income tax deduction based on the fair market value of the property.

Example of Real Estate Gift

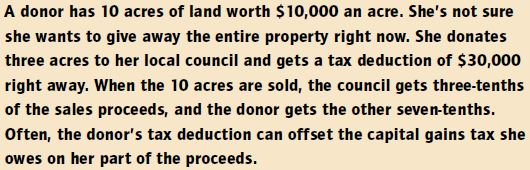

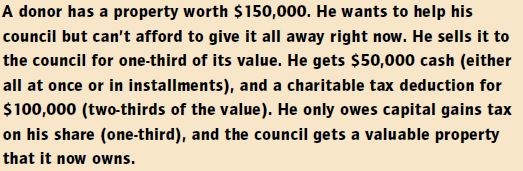

Bargain Sales and Gift/Sales

Gifts of real estate are not all-or-nothing propositions. You may donate a partial interest in the land—or certain land rights—instead of donating the entire property. You receive a deduction based on the appraised value of the interest you donate. When the property is sold, the proceeds are distributed accordingly. This is a gift/sale arrangement.

Another option is the bargain sale. Just like it sounds, the donor sells the property to the council at a bargain; it’s part sale, part gift. The council gets a good deal and the donor gets a tax deduction for the difference between the sale price and the value of the property.

Example of a Gift Sale Arrangement

Example of a Bargain Sale

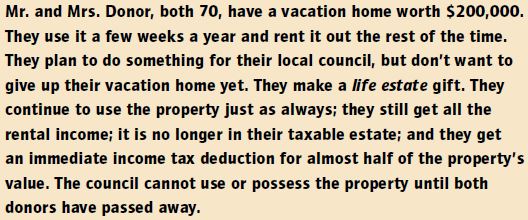

Life Estate Gifts

You may plan to contribute a home, vacation home, or farm to Scouting sometime in the future but—for now—you still want to use the property. A life estate helps you do both. A life estate gift grants Scouting the right to your property after your lifetime, but you retain the right to use and enjoy it for the rest of your life and/or the life of another. If the property is income-producing (e.g., from rent, crops, timber, etc.), you may also keep that income during your lifetime.

- If you make a life estate gift and later decide you no longer want to use your property, simply transfer your remaining rights in the property to the council. You’ll receive additional tax benefits at that time.

- The value of a tax deduction for a life estate gift is determined by the value of the land and the age of the life tenants. The older the life tenants, the larger the tax deduction.

ESTATE PLANNING TIP

You can donate real estate, receive a tax deduction, and still enjoy the property. | Scouting has no right to use or possess the property until after your lifetime, but you still receive an immediate income tax deduction for part of the property’s value. Also, a life estate gift removes the property from your taxable estate, possibly saving estate taxes and probate costs.

Example of a Life Estate Gift

Whether through inheritance, collecting, or investment, you’ve probably accumulated a lot of things. Sometimes these are inherently valuable; sometimes the value is purely sentimental;sometimes they are costly to insure or difficult to sell. Gifts of art, collectibles (such as stamps or coins), antiques, boats or cars, or other items of personal property may be great alternatives.

If the item has appreciated in value, your tax deduction is often fair market value, but it may depend on what the property is. For example, giving a valuable painting to the BSA may produce less of a tax deduction than giving that same painting to an art museum.

What if the item hasn’t appreciated in value? Your deduction is the lesser of its current value or your cost basis. Income-producing interests, such as oil and gas interests, rental property, copyrights, and others may be contributed. They make great “pretax” gifts that also generate income to support Scouting. Your tax adviser can help you with these decisions. Properly chosen, gifts of property can be outstanding gifts for you and Scouting.